texas property tax lenders

Therefore a mortgage is an encumbrance limitation on the right to the property just as an easement would be but. This isnt just for property taxesa lien can be placed if you fail to pay any taxes.

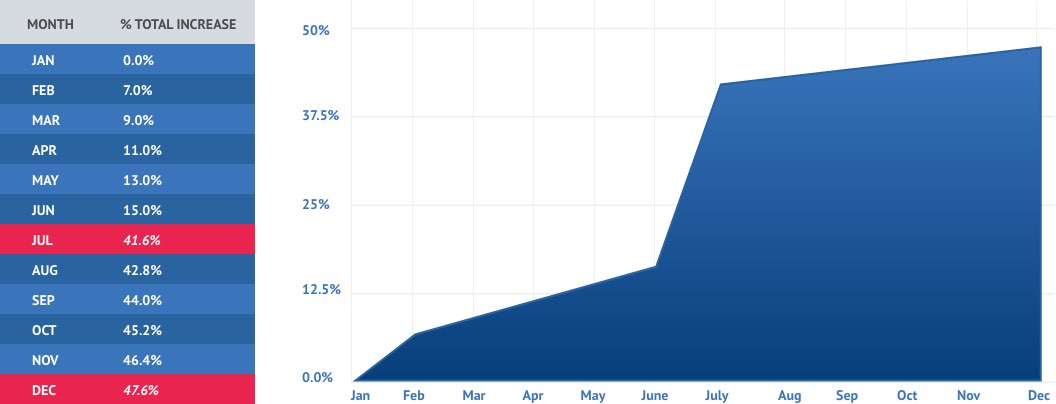

Property Tax Penalty Chart Texas Property Tax Penalties And Interest Chart Tax Ease

Mortgage lenders and servicers and other industry professionals rely.

. FICO also creates industry-specific scoring models for auto lenders and card issuers that range from 250 to 900. There are 254 counties in Texas. Lenders look most favorably on debt-to-income ratios of 36 or less or a maximum of 1800 a month on an income of 5000 a month before taxes.

HOA Liens Homeowners Associations HOAs can place a lien on the property if the owner becomes delinquent in paying the monthly fees or assessments. Considering how different credit scores use the same underlying information to try and predict the same outcome it might not be surprising that the steps you take to try to improve one score can help increase all your credit scores. Todays national mortgage rate trends.

Federal government websites often end in gov or mil. Before sharing sensitive information make sure youre on a federal government site. According to Anglo-American property law a mortgage occurs when an owner usually of a fee simple interest in realty pledges his or her interest right to the property as security or collateral for a loan.

70-100 percent may be able to deduct 12000 from their propertys taxable value. Equity build-up is the increase in the investors equity ratio as the portion of debt service payments devoted to principal accrue over time. These can be sold to others for a cash return or other benefits.

A property tax deferral exists for eligible veterans over the age of 65 and for active duty personnel. Connect with an organization that can help you manage your finances purchase a home or prevent a home foreclosure. Property Tax Liens This is a.

Haynes Boone Associate Michael Lambert appears on HB Media Minute to discuss the medias increasing use of drones in news coverage and how drone usage might be impacted by a recent federal court ruling that Texas restrictive drone law is unconstitutional. Home Buyer FAQ Marketing Resources Texas Financial Toolbox. Homeownership Team 877 508-4611.

Average property tax in Texas counties. 2 relief payments by the Administration are appropriate for all borrowers. The propertys taxable assessment and the tax rates of the taxing jurisdictions in which the property is located.

The amount of a particular propertys tax bill is determined by two things. Regulated lenders offer consumer loans with rates of interest greater than 10. These common liens are placed on any property with a mortgage.

Some tax shelter benefits can be transferable depending on the laws governing tax liability in the jurisdiction where the property is located. REAL AND TANGIBLE PERSONAL PROPERTY. Life insurance or life assurance especially in the Commonwealth of Nations is a contract between an insurance policy holder and an insurer or assurer where the insurer promises to pay a designated beneficiary a sum of money upon the death of an insured person often the policy holder.

Mortgage loan basics Basic concepts and legal regulation. Special Tax Credits available for first-time buyers. Zillow has 24 photos of this 250000 3 beds 2 baths 2017 Square Feet single family home located at 630 Riverside Dr SE Saint Cloud MN 56304 built in 1940.

B Sense of Congress--It is the sense of Congress that-- 1 all borrowers are adversely affected by COVID-19. Some states such as Massachusetts consider a chargeable accident one that involves a claim payment of more than 1000 for property damage liability collision or bodily injury coverage for. A property tax lender is a business that facilitates loans to property owners to pay off property taxes when the owner cannot pay.

The application is simple and we can get you approved within 24 hours. TAXABLE PROPERTY AND EXEMPTIONS. The declarant may not convey a unit until the secretary of state has issued a certificate of incorporation under Article 303 Texas Business Corporation Act or Article 303 Texas Non-Profit Corporation Act Article 1396-303 Vernons Texas Civil Statutes.

Michael explained the Texas law at issue which imposed civil and criminal penalties for the use of. If Texas Property Tax Exemptions Wont Work For You Find Relief at Tax Ease. For today Tuesday September 06 2022 the current average rate for the benchmark 30-year fixed mortgage is 605 up 16 basis points since the same time.

Fail to pay for home improvement. Sale of newly built Dallas-Fort Worth industrial park closes. TAXABLE PROPERTY AND EXEMPTIONS.

Are Texas Property Taxes Too High. The tax rate is determined by the amount of the tax levy to be raised from all or part of an assessing unit and the units total taxable assessed value. 50-69 percent may receive a 10000 exemption from the propertys value.

A VA loan is a mortgage. A All real and tangible personal property that this state has jurisdiction to tax is taxable unless exempt by law. A unit owners association must be organized as a profit or nonprofit corporation.

JLL marketed the property on behalf of Urban Logistics Realty. If a Texas property tax exemption is not possible for you and you need assistance paying your tax bill Tax Ease can help with a customized property tax loan thats built around your needs. Call 866 PROP-TAX for a Hunter-Kelsey Texas property tax loans to stop increasing county fees.

Were BBB A rated. Black Knights National TaxNet is a unique web-based solution that allows real estate industry professionals to quickly and easily obtain property tax information and certificates for properties in Texas. The gov means its official.

Contractors have the right to place this lien on your property which ensures they will be paid if you attempt to sell or. Depending on the contract other events such as terminal illness or critical illness can. JLL Capital Markets has closed the sale of Urban District 183 in Euless Texas.

From Harris County with nearly 5 million people to Loving County with 152 people the property tax values for each county tend to be directly influenced by each areas needs and operational costs. While the national average tends to fall between 108 and 121 Texas average effective property tax rate is above 183. Property tax lenders will make loans against due or delinquent property taxes.

Your Source for Texas Property Tax Information and Certificates. In Texas a veteran with a disability rating of. When compared to other states Texas property taxes are significantly higher.

And 3 in addition to the relief provided under this Act the Administration should encourage lenders to provide payment deferments when appropriate and. These lenders demand a top position for lien superiority.

Help My Mortgage Company Paid My Past Due Property Taxes

Texas Property Tax Loans 1 Property Tax Lender

![]()

Texas Property Tax Loans 1 Property Tax Lender

Property Tax Lenders Hunter Kelsey

Property Tax Penalty Chart Texas Property Tax Penalties And Interest Chart Tax Ease

Property Tax Lending Vs Tax Lien Transfers What S The Difference

Property Tax Lending Vs Tax Lien Transfers What S The Difference

Some Struggling To Pay Property Taxes Turning To High Interest Lenders

Property Taxes 101 Understanding Your Property Tax Propel Tax

Homestead Exemption Overview Mortgagemark Com

Property Tax How To Calculate Local Considerations

Property Taxes Texas National Title

Texas Property Tax Loans Relief Reliance Tax Loans

Texas Property Tax Loans 1 Property Tax Lender

Texas Property Tax Loans Learn Everything About Property Tax Loans In Texas Tax Ease

Top 5 Things To Know Before Getting A Property Tax Loan Home Tax Solutions

Texas Property Tax Loans Delinquent Property Taxes